Contrasting Credit Trajectories: Banks vs. Retailers

The South African credit market stands at a critical juncture marked by divergent growth trajectories between banks and retailers, elevated Non-Performing Loans (NPLs), and persistent economic pressures. These dynamics necessitate proactive strategic responses from financial institutions aiming to navigate complexity effectively.

Although banks remain key players in the credit market, the retail sector’s rapid expansion in credit issuance, coupled with escalating NPLs and fragile consumer confidence, signals for a strategic pivot to enhance growth and sustainability in lending practices amidst a challenging economic landscape.

Retailers Dominate Credit Growth

The defining feature of recent National Credit Regulator (NCR) credit bureau monitor data is overwhelming annual growth in credit issuance by the Retailers, in both volume and value terms. Conversely, banks experienced muted volume growth and marginally negative growth in the value of credit granted. Specifically:

Secured lending, compromising mortgages and other secured facilities including furniture, increased marginally year on year (1%), whilst short term credit, which is made up of loans of less than R8,000 over a period of 6 months or less, demonstrated growth of up to 26% year-on-year.

| Secured Lending | 1% | Credit for mortgages and other secured facilities including furniture marginally up by 1% year-on-year. | |

| Short-Term Credit | 26% | Loans below R8,000, repayable within 6 months, surged by 26% year-on-year. | |

| Credit Facilities | 30% | Credit Facilities including credit cards, store cards, and overdrafts, increased nearly 30% in account numbers. Credit cards comprised 16% of these accounts, whereas store cards represented 78%. Notably, credit and garage cards grew by 10%, while store cards saw remarkable 41% growth year-on-year. |

Pressure on Consumers: Rising Debt and NPLs

This growth occurs against a backdrop of adverse consumer debt dynamics, with household debt as a percentage of disposable income remaining elevated (slightly improving from 62.6% to 62.2% from late 2023 to Q3 2024). High debt service costs continue to burden consumers, consuming 9.1% of household income. Consequently, Non-Performing Loans (NPLs) have risen across mortgages, credit facilities, unsecured credit, and short-term credit—only secured lending shows annual improvement.

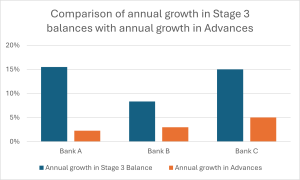

Further illustrating these pressures, full-year results from South Africa’s top four banks show increasing NPLs for three banks. Stage 3 balances have also significantly outpaced advances in growth year-on-year (see fig 1). It is clear that the credit taps and growth have tightened significantly.

Strategic Recommendations for Financial Institutions

Given these trends, banks are recalibrating their risk appetites and tightening credit issuance. This competitive, yet cautious atmosphere, necessitates the need for enhanced decisioning capabilities in order to ensure sustainable growth. Leaders will emerge that can find growth pockets and increase risk appetites whilst lagging indicators and NPLs wash through the lifecycle.

Financial institutions should urgently consider:

- Enhanced Credit Analytics: Deploy robust, advanced analytics and decision-making frameworks to enhance risk assessment precision and customise product offerings.

- Follow the leads of retailers: Expand the use of alternate data in credit risk decisions, especially for thin file clients new to the credit market. Retailers are seen by many as leaders, partly because they possess high-frequency, behaviour-rich data. Financial institutions should be encouraged to co-create credit solutions through partnerships, especially with telcos, fintechs, and large retail platforms.

- Agile Risk Management: Dynamically adjust risk appetites and refine collection strategies to balance competitiveness and control NPL growth effectively.

- Innovative Credit Offerings: Explore new innovative credit products tailored to evolving consumer preferences, particularly leveraging opportunities evident within the retail sector’s rapid credit growth.

- Engage in Strategic Data Partnerships: Explore strategic alliances with ecosystem partners to gain visibility on cash flows, payment patterns, and purchasing habits—turning data into lending signals.

Innovation Ideas for Credit Offerings

| Idea | Summary | Benefit |

| Embedded Credit at Point-of-Sale | Credit seamlessly integrated into retail or ecommerce journeys. | Increases conversion and captures real-time behavioral signals. |

| Flexible Repayment Models | Credit products designed for variable income earners (e.g., gig workers). | Improves affordability and lowers delinquency among underbanked segments |

| Subscription-Based Credit Access | Flat monthly fees providing access to revolving credit, bundled with perks. | Builds loyalty and improves revenue predictability. |

| Credit Builder Products | Small, secured loans to help thin-file customers build a track record. | Expands access while managing loss exposure. |

| Purpose-Based Lending

|

Loans tied to specific goals—e.g., education, mobility, home upgrades—with usage-linked terms. | Aligns credit products with consumer intent and improves repayment behavior. |

The Strategic Imperative

Ultimately, the NCR data and banks’ financial statements underscore a pressing need for strategic agility and data-driven decision-making. Leaders that swiftly enhance their analytics capabilities, adjust risk approaches, and innovate product portfolios will not only manage risks effectively but also capture opportunities for sustainable growth in South Africa’s complex economic landscape.

Principa’s core competencies in credit analytics, decisioning solutions, and strategic advisory are uniquely aligned to these challenges. Connect with us to strengthen your strategic response and position for future growth.